Stonewell Bookkeeping Can Be Fun For Everyone

Table of ContentsThe Single Strategy To Use For Stonewell BookkeepingStonewell Bookkeeping Can Be Fun For EveryoneThe Facts About Stonewell Bookkeeping RevealedNot known Incorrect Statements About Stonewell Bookkeeping Things about Stonewell Bookkeeping

Every service, from handmade cloth manufacturers to video game programmers to dining establishment chains, earns and invests cash. Bookkeepers assist you track all of it. What do they really do? It's difficult understanding all the response to this question if you've been only concentrated on growing your company. You may not totally understand and even start to totally value what an accountant does.The history of accounting go back to the start of business, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers maintained records on clay tablets to maintain accounts of purchases in remote cities. In colonial America, a Waste Book was typically made use of in bookkeeping. It contained a day-to-day journal of every transaction in the chronological order.

Small companies may depend only on a bookkeeper initially, but as they expand, having both professionals on board comes to be significantly valuable. There are two major kinds of bookkeeping: single-entry and double-entry accounting. records one side of an economic transaction, such as adding $100 to your expense account when you make a $100 purchase with your debt card.

The Ultimate Guide To Stonewell Bookkeeping

involves tape-recording financial transactions by hand or making use of spread sheets - small business bookkeeping services. While low-cost, it's time consuming and susceptible to errors. uses tools like Sage Cost Monitoring. These systems instantly sync with your credit rating card networks to give you charge card transaction information in real-time, and immediately code all information around costs consisting of jobs, GL codes, places, and classifications.

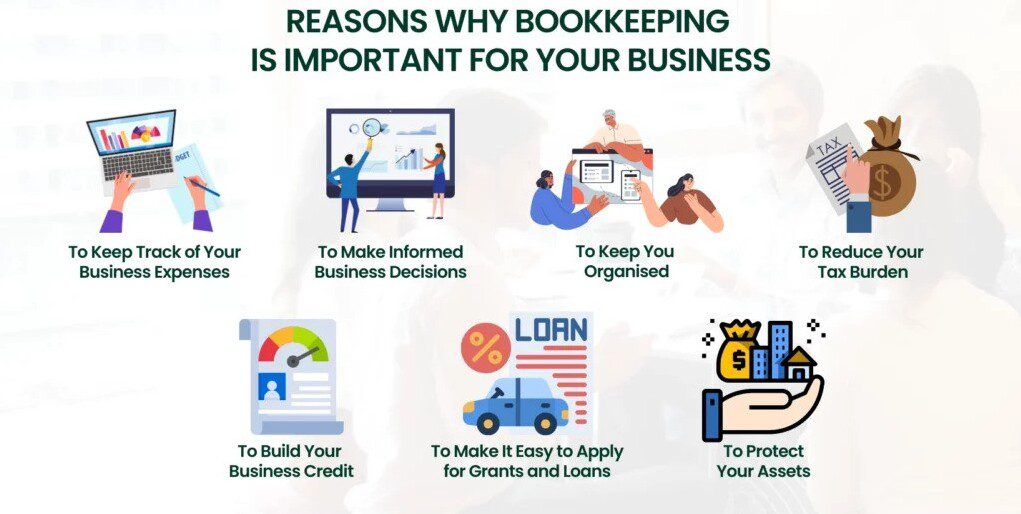

They guarantee that all paperwork sticks to tax obligation regulations and regulations. They keep an eye on cash money circulation and regularly produce financial reports that aid key decision-makers in an organization to push business onward. In addition, some bookkeepers also help in maximizing payroll and billing generation for a company. An effective accountant needs the following abilities: Precision is type in economic recordkeeping.

They typically begin with a macro viewpoint, such as an annual report or a revenue and loss statement, and afterwards drill right into the details. Bookkeepers ensure that vendor and consumer documents are always up to date, also as people and companies adjustment. They may additionally need to coordinate with other divisions to make sure that everybody is using the very same information.

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Entering expenses right into the accounting system enables for accurate planning and decision-making. This helps services get payments quicker and boost money flow.

Involve internal auditors and compare their matters with the taped values. Bookkeepers can work as consultants or internal employees, and their compensation varies depending on the nature of their employment.

That being claimed,. This variant is influenced by aspects like location, experience, and ability degree. Freelancers usually charge by the hour yet may use flat-rate plans for certain tasks. According to the United States Bureau of Labor Data, the typical bookkeeper wage in the USA is. Bear in mind that salaries can differ depending upon experience, education, place, and sector.

Not known Incorrect Statements About Stonewell Bookkeeping

Some of the most usual paperwork that organizations need to submit to the federal government includesTransaction details Financial statementsTax compliance reportsCash circulation reportsIf your accounting is up to date all year, you can stay clear of a bunch of stress and anxiety during tax period. Bookkeeping. Patience and interest to information are vital to better bookkeeping

Seasonality belongs of any kind of job worldwide. For accountants, seasonality suggests durations when settlements come flying in through the roofing, where having outstanding work can end up being a serious blocker. It becomes important to expect these minutes in advance and to complete any backlog prior to the pressure duration hits.

How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Preventing this will decrease the danger of setting off an internal revenue service audit as it supplies an accurate depiction of your financial resources. Some usual her explanation to maintain your individual and service funds separate areUsing a service credit card for all your service expensesHaving separate monitoring accountsKeeping invoices for individual and overhead separate Visualize a world where your bookkeeping is done for you.

These combinations are self-serve and require no coding. It can instantly import information such as employees, projects, classifications, GL codes, divisions, job codes, cost codes, taxes, and a lot more, while exporting expenditures as expenses, journal entries, or credit rating card costs in real-time.

Consider the complying with pointers: An accountant that has actually collaborated with organizations in your market will certainly better understand your details demands. Qualifications like those from AIPB or NACPB can be a sign of trustworthiness and proficiency. Ask for references or inspect online reviews to ensure you're employing somebody reputable. is a great area to begin.